- Home

- Views On News

- Nov 15, 2023 - Our Take on the Tata Technologies IPO: The Good, the Bad and the Ugly

Our Take on the Tata Technologies IPO: The Good, the Bad and the Ugly

Given the growing hype surrounding the Tata Technologies IPO, I feel this is the perfect time to analyse what is the best time to buy an IPO.

You see, in most cases, less than 10-15% of the total IPO is allocated to retail investors.

If you add factors such as your brokerage account, account balance, and the historical trading patterns which all contribute to whether you get the IPO shares or not, the chances of you making it into the IPO allotment are bleak.

So, for investors who miss the IPO bus, what is the best time to buy into a recently IPO'd stock?

We'll get to that but first, let's understand the nuances of India's most awaited IPO of 2023.

Tata Technologies, a wholly owned subsidiary of Tata Motors, is set to be the first Tata Group company to go public in nearly two decades.

The Tata Tech offer-for-sale (OFS) will commence on 22 November 2023 and close on 24 November 2023.

The issue size is for 60.9 million equity shares. Out of this, 46.3 million equity shares will be put up for sale by the company, while 9.7 million shares will be offered by Alpha TC Holdings. Up to 4.9 million shares will be offered by Tata Capital Growth Fund.

The IPO issue size was trimmed after Tata Motors sold 9.9% of its stake recently to new investors at an enterprise valuation of Rs 163 bn. Before this sale, Tata Motors held 74.69% stake in Tata Technologies.

It's easy to dismiss Tata Tech's performance as yet another stock that is caught up in the current electric vehicle (EV) hype train, led by other Indian companies such as Tata Elxsi and KPIT Technologies.

But in this week's analysis, let's deep dive into the history of Tata Technologies, what made it so successful, and finally, if the current valuation justified.

The Company

Tata Technologies provides engineering and development services, digital enterprise services, product lifecycle management, education offerings, and IT service management to businesses across automotive, aerospace, industrial machinery, and other industries.

It works with manufacturing companies to solve complex problems by offering the right kind of solution which can enhance the company's profitability.

Using its deep understanding of engineering principles and technologies, the company combines traditional engineering and modern digital technology to transform good ideas into real and sustainable products.

The company covers every aspect of the value chain starting from product conceptualization to aftermarket maintenance repair, and operations.

The company is headquartered in Pune, and was founded as a business unit of Tata Motors in 1989.

Products

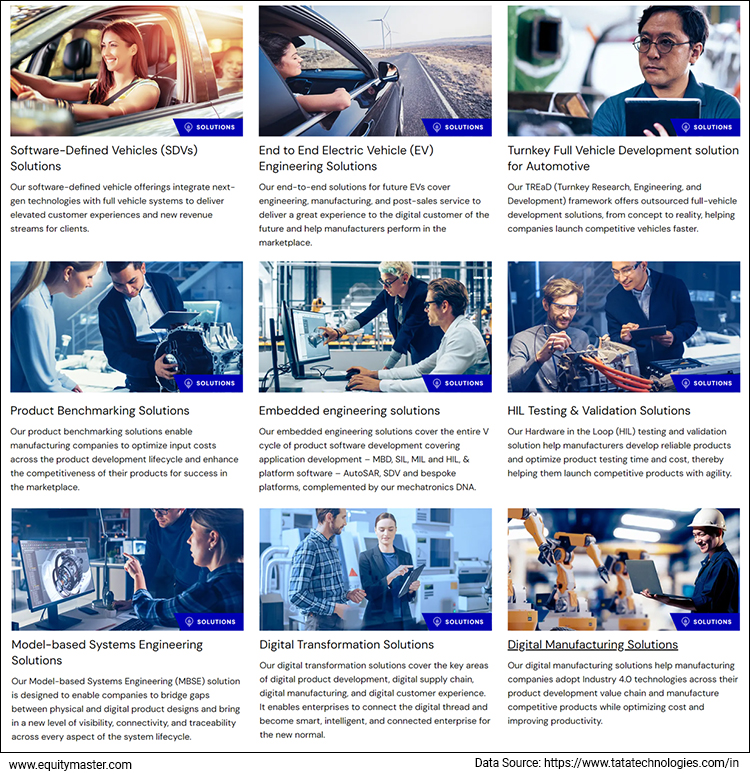

Tata Technologies' product line is very straightforward as of now.

It's not your average tech company rather a global engineering services firm specialising in innovative product development and digital solutions.

Tata Technologies caters primarily to international automobile original equipment manufacturers (OEMs) and their key suppliers (ancillaries).

It also serves the aerospace and industrial heavy machinery industries.

Here are some of its products.

We also went through the reviews for these products and they are nothing short of phenomenal.

No matter the reviews, at least we can rest easy knowing that the company has a good product portfolio.

Over the last couple of years, the company innovated end-to-end turnkey product development solutions as well as accelerators that are being leveraged by traditional OEMs as well as start-ups to launch competitive products faster.

Investors and Partnerships

More than the product, we could also argue that Tata Technologies' management has been exceptional in choosing the right investors in the company.

Ahead of the IPO, the company is in talks with Morgan Stanley Investment Management, Blackrock and some US based hedge funds to invest in its initial public offering.

One of the biggest drivers for the current valuation is the stake sale by Tata Motors last month where it entered into share purchase agreements to sell 9.9% stake in Tata Technologies for Rs 16.1 bn.

In 2020, the company tied up with GKN Automotive, a global leader in driveline systems and advanced ePowertrain technologies. It opened a global e-mobility software engineering centre in Bengaluru in October 2020.

This tie up is a significant development for the company as over 50% of EVs sold globally use parts manufactured by GKN. Tata Technologies will develop software and embedded electronics as part of the tie-up.

Even in the aerospace segment, Tata Technologies is a preferred partner for leading aerospace OEMs.

It also has an education offering where the company's eLearning platform offers learning methodology for 2,000 plus self-paced courses and niche skill sets. The platform is widely used and preferred by more than 500,000 members worldwide to meet their learning goals.

Challenges

The company has listed out some obvious challenges that every company faces in its 'risk factors' section of the draft prospectus.

Here are some of them.

- Concentrated customer base: Tata Technologies derives a significant portion of its revenues from its top 5 clients. If any or all of these clients face any deterioration in their business, it could have a negative impact on the company's financial performance.

- Reliance on the automotive sector: Tata Technologies' revenue is heavily dependent on the automotive sector. Any economic slowdown in this sector could adversely impact the company's financial condition and operations.

- Uncertainties about new energy vehicle companies: The company expects a significant inflow of future revenue from new energy vehicle companies, many of which may be start-ups. These companies may face uncertainties about their funding plans, future roadmaps, growth capabilities, creditworthiness, and ownership changes.

- Reliance on single-source and limited-source suppliers: For its products business, Tata Technologies relies on vendors and partners for software. Many of these are single-source or limited-source suppliers. This dependence or an adverse change in the relationship between them could impact availability, delivery, reliability, and costs.

Valuations of Tata Technologies

Since the company has not yet announced the price band, we don't have much to say about the valuations part.

There are a lot of reports circling around saying the company could fix the price band between Rs 300-320. While a report from a leading financial website says that the price band could be around Rs 400 to Rs 542 as valuations fall around Rs 220 bn, going by the recent 9.9% stake selling by Tata Motors.

We'll do a complete breakdown of valuations once the company announces price band and more details are out.

The company is currently valued at US$ 2 bn or Rs 163 bn. This could be a hard pill to swallow for many investors.

One important thing to note is that it does not make sense to use legacy tech companies' valuation to evaluate companies like Tata Technologies.

What we can do is to compare the stock with its peers - KPIT Technologies, Tata Elxsi, and L&T Technology.

Comparative Analysis

| Company | Tata Technologies | Tata Elxsi | KPIT Tech | L&T Technology |

|---|---|---|---|---|

| ROE (%) | 27.1 | 41.0 | 21.9 | 25.9 |

| ROCE (%) | 38.1 | 51.8 | 29.2 | 36.8 |

| Latest EPS (Rs) | 5.4 | 126.1 | 11.1 | 112.3 |

| TTM PE (x) | - | 64.1 | 126.6 | 37.9 |

| TTM Price to book (x) | - | 24.1 | 25.6 | 9.9 |

| Dividend yield (%) | - | 0.8 | 0.3 | 1.1 |

| Industry PE | 29.2 | |||

| Industry PB | 8.8 | |||

Conclusion

Without a doubt, Tata Technologies is a fundamentally strong company.

It is evident that no matter which industry it is present in, Tata Technologies is a specialist rather than a generalist which ensures that its offerings are irreplaceable and would continue to remain in high demand over the long term.

Also considering the growth of tech in the decade gone by and the number of unicorns created within the space, the assumption that's going in close circles these days is that these tech IPOs would generate even better returns than the average IPO.

Tech as a whole has performed phenomenally, however it's largely because of the growth seen in few established companies.

On timing, I don't think even if they wanted to, they could have chosen a better time to launch their IPO. The grey market premium of unlisted shares of Tata Technologies has already shot up a lot in anticipation.

Coming to the question on when is the right time to buy into an IPO stock... should it be on the listing day itself or should you wait a day, week or even a month for all the hype surrounding the IPO to die down? So that the stock could possibly come back to its "real" valuation...

Studies show that the highest returns are obtained by someone who invested on the day of the IPO itself. It's all about the basics...the more amount of time you wait, the lesser your returns would be!

But if you are a long-term investor, and believe in the approach of buy and hold investing, you would be better off buying shares of the newly listed company after waiting a week or two, as during this time, it's when the hype usually dies down or fuels up.

This way, you get to see how it performs in the market, avoid any large swings that the first week might cause, and still come out on top over the long run!

Happy Investing.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Our Take on the Tata Technologies IPO: The Good, the Bad and the Ugly". Click here!

1 Responses to "Our Take on the Tata Technologies IPO: The Good, the Bad and the Ugly"

Yalavarthirao

Dec 3, 2023Very good informative article.